Navigating the world of accounting software can feel overwhelming, especially when you’re trying to decide between free and paid options. You might find yourself torn between popular choices like Wave Accounting and QuickBooks, both offering unique features and pricing models.

But which one truly fits your needs? Imagine finding a solution that not only saves you money but also simplifies your financial management. You deserve an accounting tool that aligns perfectly with your business goals, whether you’re a solo entrepreneur or a growing company.

We’ll break down the pros and cons of Wave Accounting and QuickBooks, exploring their free and paid versions, so you can confidently choose the right path for your business. Stick around to discover which option will empower your financial decisions and streamline your operations.

Overview Of Wave Accounting

Wave Accounting is a powerful tool for small business owners. It offers free accounting software designed to simplify financial management. Users can access various features without paying a dime, making it ideal for startups and freelancers. The platform provides essential tools to track income and expenses efficiently. Here’s a deeper look into what Wave Accounting offers.

Features Of Wave Accounting

Wave Accounting provides several valuable features. It allows users to create professional invoices effortlessly. You can also track payments and manage customer information. The software offers receipt scanning capabilities. Users can easily capture and organize receipts. Wave Accounting integrates with bank accounts for seamless transaction tracking. It also provides financial reports to help understand business performance.

Cost Structure Of Wave

Wave Accounting is free for its core accounting features. Users don’t pay for invoicing, expense tracking, or financial reports. Some services, like payroll and payment processing, are paid. Payroll services have different pricing depending on the state. Payment processing fees are competitive compared to other platforms. The free features cover most basic accounting needs for small businesses.

Pros And Cons Of Wave

Wave Accounting offers several advantages. Its cost-free accounting is beneficial for budget-conscious users. The software is user-friendly, making it accessible to non-accountants. Integration with banks and receipt scanning saves time. However, it lacks some advanced features. Larger businesses may need more comprehensive tools. Customer support options are limited compared to paid services. Despite this, Wave remains a solid choice for many small businesses.

Wave Accounting Free Options

Wave Accounting offers a robust free option for managing your finances. Perfect for small businesses or freelancers with tight budgets. Its free version boasts an array of features. Users can handle invoicing, accounting, and much more without spending a dime. It’s a go-to choice for many seeking cost-effective financial solutions.

Included Features In Free Version

Wave’s free version includes several essential tools. Users can create and send unlimited invoices. They can also track expenses effortlessly. Another feature is receipt scanning through the mobile app. Users can manage their accounting with double-entry bookkeeping. Wave also allows for collaboration with accountants through guest access. These features cover many basic needs without any financial commitment.

Limitations Of Free Version

Despite its many features, Wave’s free version has limitations. Users won’t find payroll services included. Advanced reporting options are missing. There’s also no dedicated support team. Only self-service help through articles and guides is available. Lastly, Wave lacks inventory management features. These might be essential for some businesses. Understanding these limitations is crucial for making an informed choice.

Wave Accounting Paid Options

Wave Accounting offers a robust free version. But some users seek more. The paid options cater to those needing additional support and features. These options enhance the overall experience. They provide more tools for growing businesses.

Additional Features In Paid Version

The paid version of Wave Accounting includes premium customer support. This means quicker response times and priority assistance. It also offers payroll services. You can manage employee payments and tax filings with ease. Another feature is bookkeeping support. Professionals help you maintain accurate records. These features are designed to streamline your accounting tasks.

Pricing Of Paid Services

Wave’s paid services have different pricing structures. The payroll service has a monthly fee. It starts at $35 plus $6 per active employee. The bookkeeping service is customized. It depends on the complexity of your business needs. Pricing is transparent and designed to fit small business budgets.

Credit: www.globalfpo.com

Overview Of Quickbooks

QuickBooks is a popular accounting software for small to medium businesses. It offers a range of financial management tools. Users can track income and expenses with ease. The software simplifies invoicing and helps manage cash flow. QuickBooks integrates with many apps, enhancing its functionality. It suits businesses with varied accounting needs.

Features Of Quickbooks

QuickBooks offers a variety of features to users. It includes invoicing, expense tracking, and payroll management. The software provides real-time financial reporting. Users can also benefit from inventory management tools. QuickBooks supports multiple currencies, which is beneficial for international transactions. The cloud-based version ensures access from any device.

Cost Structure Of Quickbooks

QuickBooks has several pricing tiers. The cost varies with features and business size. There is a free trial available for new users. Paid plans start at a monthly fee. Higher tiers offer more advanced features. Discounts are often available for annual subscriptions. Users choose based on their specific business needs.

Pros And Cons Of Quickbooks

QuickBooks has many benefits. It is user-friendly and widely used. The software offers comprehensive features for accounting needs. It integrates with a wide range of third-party apps. On the downside, some users find it pricey. Others may face a learning curve initially. Customer support can be inconsistent at times.

Quickbooks Free Options

QuickBooks offers a free trial for users interested in exploring its features. This allows potential users to evaluate the software before committing financially. The trial provides a glimpse of what QuickBooks can do for managing finances. Through this trial, users can assess its suitability for their business needs.

Trial Features In Free Version

The QuickBooks free trial offers access to many of its core features. Users can track income and expenses efficiently. It supports invoicing and payments, making business transactions smoother. Bank connections allow for easy transaction import. Users can also generate basic financial reports.

Limitations Of Trial Version

While the trial is useful, it has some limitations. The free trial lasts only 30 days. After this period, users must subscribe to continue. Some advanced features remain locked during the trial. Users have limited access to integrations with third-party apps. The trial version is not ideal for large or complex businesses.

Quickbooks Paid Options

QuickBooks stands as a popular choice for managing finances. Its paid options offer comprehensive tools tailored for small businesses. Users can choose from different subscription tiers, each packed with features to streamline accounting tasks. This section explores the subscription tiers and pricing of QuickBooks paid plans.

Subscription Tiers And Features

QuickBooks offers multiple subscription tiers. Each tier caters to different business needs. The Essentials plan helps track income and expenses. It includes features like invoice creation and payment tracking. The Plus plan adds project tracking and inventory management. Advanced users might prefer the Premium plan. It includes advanced reporting and personalized insights. All plans offer mobile access and automatic data backups.

Pricing Of Paid Plans

Pricing varies across QuickBooks paid plans. The Essentials plan starts at a reasonable monthly fee. This plan suits small businesses with basic accounting needs. The Plus plan costs a bit more. It serves businesses needing project management features. The Premium plan requires a higher monthly investment. It targets businesses seeking detailed insights and analytics. Discounts are sometimes available for annual subscriptions. Consider your business requirements when choosing a plan.

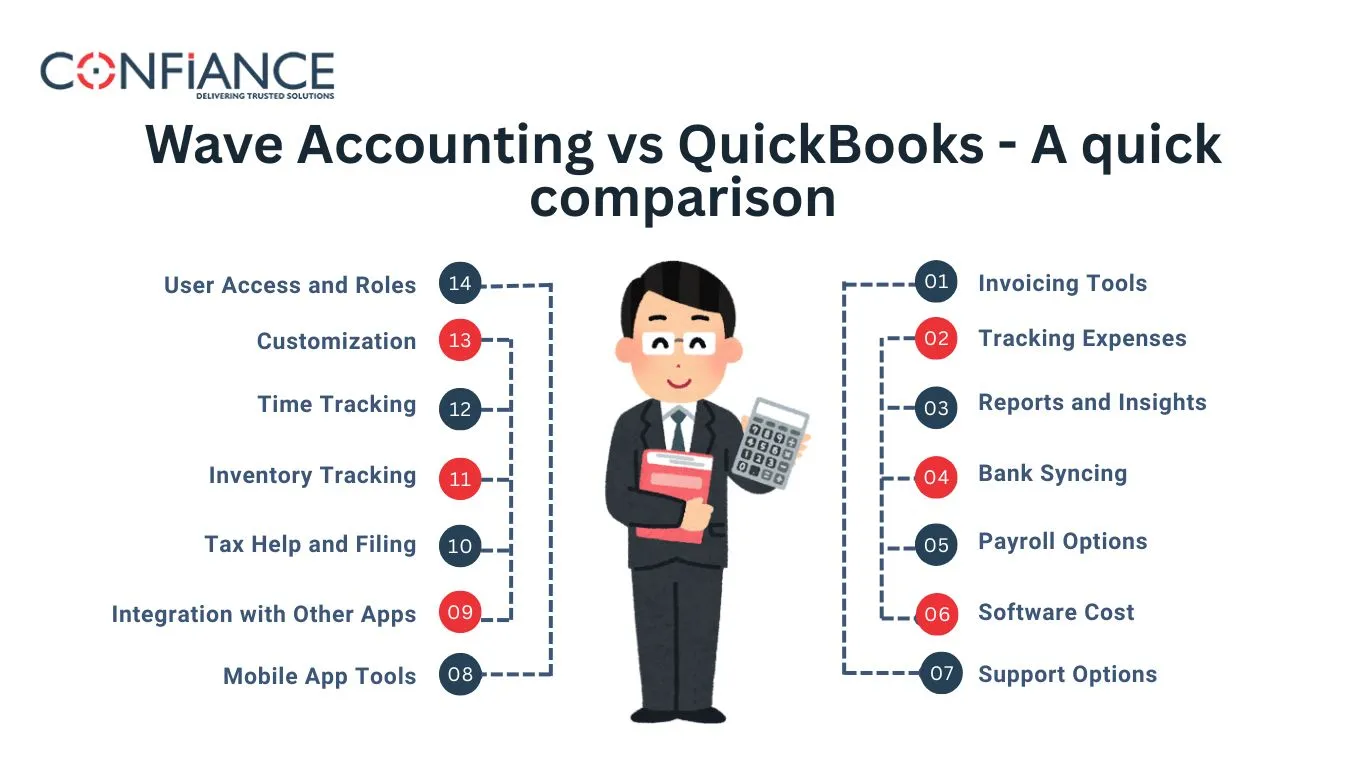

Comparison Of Wave And Quickbooks

Choosing the right accounting software can feel like picking the perfect pair of shoes. You want something that fits well and supports your needs. Wave Accounting and QuickBooks are two popular options that offer different features, costs, and ease of use. Understanding these differences can help you decide which is best for your business.

Feature Comparison

Wave Accounting offers a solid range of free features that cater to small businesses. You get invoicing, expense tracking, and even receipt scanning without paying a dime. QuickBooks, on the other hand, is more feature-rich, especially in its paid versions. It provides advanced tools like inventory management and customizable reports.

Imagine running a small bakery; with Wave, you can easily track your expenses and send invoices to clients. But if your bakery grows and you need inventory tracking, QuickBooks might be more suitable. Think about your business needs now and what they might look like in the future.

Cost Comparison

Wave is known for its unbeatable price—free. This is a huge advantage for startups or businesses with tight budgets. QuickBooks offers both free and paid options, with its paid versions ranging from affordable to premium pricing. The free version is quite limited compared to Wave’s offerings.

Consider your budget and what you’re willing to spend. If you’re just starting out, Wave’s free features might be all you need. But if you’re looking for more robust capabilities, investing in QuickBooks might be worth it. Is it better to save money now or invest in future growth?

Ease Of Use

Wave is often praised for its user-friendly interface. It’s simple to navigate, making it a great choice for those less familiar with accounting software. QuickBooks, while comprehensive, can be a bit daunting initially due to its myriad of features.

Think about your comfort level with technology. If you prefer straightforward, easy-to-use software, Wave is a good choice. However, if you’re up for a challenge and willing to learn, QuickBooks provides a powerful suite of tools. Are you ready to dive deeper into accounting complexities?

Ultimately, the decision between Wave Accounting and QuickBooks hinges on your business’s specific needs, budget, and your tech-savvy comfort level. What will support your business best today and tomorrow?

Credit: confiancebizsol.com

User Experience And Support

When deciding between Wave Accounting and QuickBooks, understanding the user experience and support options is crucial. Both platforms offer unique features tailored to different needs, but how they handle user experience and support might be the tipping point for you. Let’s delve into the specifics, focusing on customer support options and user feedback and satisfaction.

Customer Support Options

Good support can save you time and frustration. Wave Accounting offers free support through email, with a promise of responses within 24 hours. They also have a comprehensive help center with guides and articles.

QuickBooks, on the other hand, provides a tiered support system. With their free version, you get access to community forums and online resources. Paid plans offer more personalized support, including phone and chat options, which can be a lifesaver when you’re stuck on a complex issue.

Imagine needing urgent help with your accounting software. Would you prefer waiting for an email response, or having someone guide you through the problem over the phone? Consider what level of support you need before choosing a platform.

User Feedback And Satisfaction

User feedback is a powerful indicator of how well a service meets expectations. Wave Accounting users often praise its simplicity and ease of use, especially for small business owners who aren’t accounting experts. However, some users feel the email support could be more responsive.

QuickBooks users generally appreciate its robust features and detailed tutorials. Yet, some find it overwhelming due to its complexity. Paid users often report higher satisfaction due to the enhanced support options available to them.

Your experience with these platforms might differ based on your business needs and technical expertise. Have you ever tried both? Which one felt more intuitive for you, and did the support meet your expectations?

Which Is Right For Your Business?

Choosing the right accounting software for your business is crucial. Wave Accounting and QuickBooks both offer unique features. They cater to different business needs and financial goals. Understanding their free and paid options helps you make informed decisions. This guide explores key factors influencing your choice.

Factors To Consider

Cost is a major factor. Wave Accounting is free, which is attractive for startups. QuickBooks offers both free and paid options. Paid plans provide more features and support. Consider what fits your budget and needs.

User experience matters. Easy-to-use software saves time. Wave is simple and straightforward. QuickBooks has more advanced features. Evaluate which interface suits your team.

Technical support is essential. QuickBooks offers robust support with paid plans. Wave has limited support. Think about how much help your team might need.

Business Type And Needs

Different businesses have unique needs. Freelancers and small businesses often prefer Wave. It’s free and easy to use. QuickBooks is better for larger companies. It handles complex financial tasks efficiently.

Consider the complexity of your business operations. Do you need inventory tracking? Detailed financial reports? QuickBooks excels in these areas. Wave is great for basic accounting tasks. Match software capabilities to your business requirements.

Scalability And Growth

Think about future growth. Wave is excellent for startups. But, QuickBooks scales better with business expansion. It offers advanced tools for growing companies.

Evaluate how software can adapt to your changing needs. QuickBooks provides options to upgrade plans. As your business grows, its features expand. Wave may require switching to another software for larger operations.

Choose a platform that supports your long-term goals. Scalability ensures smooth transitions as your business evolves.

Credit: zapier.com

Frequently Asked Questions

Is Wave Accounting Better Than Quickbooks?

Wave Accounting is ideal for small businesses due to its free features. QuickBooks offers advanced tools for larger operations. The best choice depends on business size and needs. Wave suits freelancers and small business owners, while QuickBooks is better for growing enterprises requiring comprehensive accounting solutions.

What Are The Drawbacks Of Wave Accounting?

Wave Accounting lacks advanced features for large businesses. It offers limited integrations and customization options. User support is minimal, relying heavily on self-help resources. Mobile app functionality is restricted, and payroll services are not available in all countries. Reporting capabilities are basic compared to competitors.

Is Wave Accounting Really Free?

Yes, Wave Accounting offers free accounting and invoicing software for small businesses. Some premium features, like payment processing and payroll, come with fees. The core accounting tools remain free, making it a budget-friendly option for entrepreneurs. It’s a reliable choice for managing finances without extra costs.

Why Do Accountants Not Like Quickbooks Online?

Accountants often find QuickBooks Online lacking in advanced features and customization. They face issues with data entry limitations and reporting flexibility. The platform sometimes struggles with handling complex accounting tasks. Accountants also express concerns about data security and integration with other software.

These factors contribute to their dissatisfaction.

Conclusion

Choosing between Wave Accounting and QuickBooks depends on your needs. Both offer free and paid versions. Wave suits small businesses needing basic features. QuickBooks provides more advanced options for growing businesses. Cost is a big factor. Wave’s free version is quite robust.

QuickBooks offers more tools, but at a price. Consider your business size and budget. Evaluate which features matter most for you. Your decision should align with your financial goals. Make sure the software supports your future growth. Select wisely to enhance your financial management.